On Wednesday, October 28th, BGV hosted an interactive webinar alongside the Kyoto Research Park (KRP), a Japanese venture accelerator that hosts over 480 tenant companies and institutions in the field of ICT, Biotech, Electronics, Machinery and innovation. With over 100 attendees tuned in, and overflow viewers watching via YouTube, BGV Founder and General Partner Eric Benhamou and GP Eric Buatois laid out the firm’s Enterprise 4.0 investment thesis and showcased several portfolio companies to the Japanese hi tech community. Presentations provided an in-depth look at the successes of Enterprise 4.0 startups, laying out market indicators to substantiate key trendlines in their firm’s investment outlook, and highlighting BGV’s cross-border investment strategy. The event included presentations by BGV portfolio companies Scalefast, Secret Double Octopus, and Drishti.

To view the VOD, please click here.

BGV Founder Eric Benhamou Discusses The COVID Impact and the Enterprise 4.0 Window of Opportunity

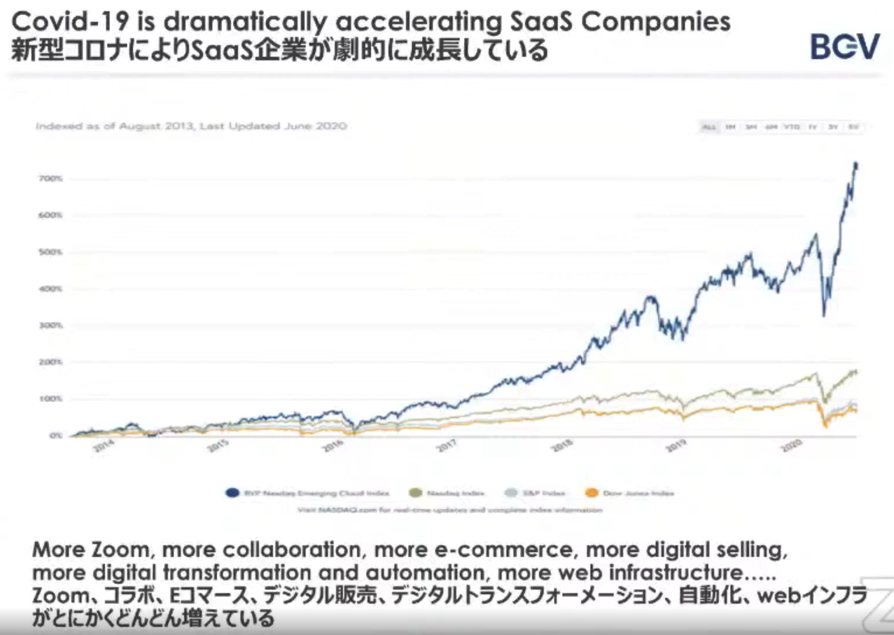

COVID-19 has accelerated the automation of the enterprise business, and quickened the pace of digital transformation, according to Eric Benhamou. Amongst the more interesting developments of 2020, enterprise businesses have successfully shifted to a remote workplace backed by a distributed workforce. The “work from home” transition occurred virtually overnight to assure companies could remain stable and competitive in their respective industries. As a result, enterprise businesses were forced to adopt a wide array of SaaS-based solutions to execute this transition. The reliance on digital collaboration and remote working tools helped drive an almost 400% increase in stock value for the BVP Nasdaq Emerging Cloud index, largely comprised of enterprise SaaS companies, since the beginning of the year.

On the consumer side of the equation, customers have learned to lean-in and habituate themselves to online shopping and e-commerce. The convenience of fast, affordable and reliable delivery, coupled with myriad goods and services — from food and groceries, to home and office equipment, to specialized medicines or niche products — has proven itself in the market. Major players like Amazon and Disney have shifted focus in their overall business model to tailor to the WFH lifestyle. Fast and affordable purchases, combined with “ease of consumption,” have become the underlying motivators guiding businesses in the online retail world, and setting a standard that customers want and expect from online providers.

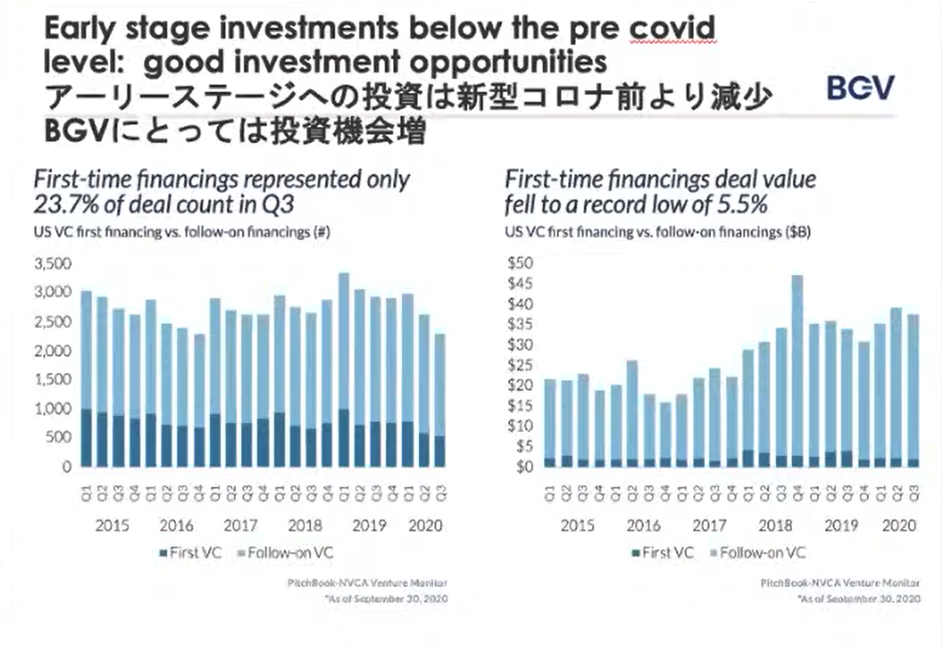

With the impact of COVID-19 affecting every industry sector, a window for investment opportunities has opened. While competing funds shift their focus and investment dollars downstream, to later-stage companies, this allows for lower valuations and greater access to invest in many more attractive early-stage companies. BGV is strategically and financially well-positioned to target and capitalize on this window of opportunity. The last five quarters have seen a decline in the number of investments, and in the capital raised, for early-stage entities. This reduced competition sets the stage for the emergence of attractive Enterprise 4.0 deals in this transitionary period. For reference, Enterprise 4.0 refers to a new wave of cloud native startups that combine artificial intelligence, intelligent automation and proprietary access to data to deliver actionable insights for enterprise businesses. These startups provide vertical, full-stack solutions that generate immediate ROI impact for their customers. Under this rubric, BGV foresees the following seven investment themes:

- Customer-centric SaaS solutions that redefine the customer experience

- Embedded AI that incorporates voice, computer vision and/or robotics to redesign applications

- A New Architecture to deliver computing and storage power leveraging Enterprise 4.0

- Cloud Native Security innovations that that shift cybersecurity towards automation and analytics, addressing skilled labor and “ease of use” concerns for end consumers

- Traditional market improvements in manufacturing, automotive, logistics, and other sectors that face the most significant dislocations from the push towards automation

- Robotics augmenting human productivity in vertical markets (i.e. food processing)

- The Amazon effect — as discussed above — creating technology opportunities to level the playing field in e-commerce and logistics

BGV General Partner Eric Buatois Presents The Global Venture Perspective: A Snapshot

At first glance, US venture investments remain robust, particularly in cloud technology, with expectations to exceed the levels of 2019. However, capital is skewing towards later-stage companies, and later stage investment rounds. With deal counts for first-time-financings at record lows (just 23.7% of activity when compared to later stage deals), 2020 is also on pace to set record low deal valuations, representing just 5.5% of VC investments when compared to the value of follow-on investments This bolsters BGV’s position in the thinned out field of early stage investors, generating more attractive dealflow and yielding a better negotiating posture with early stage opportunities.

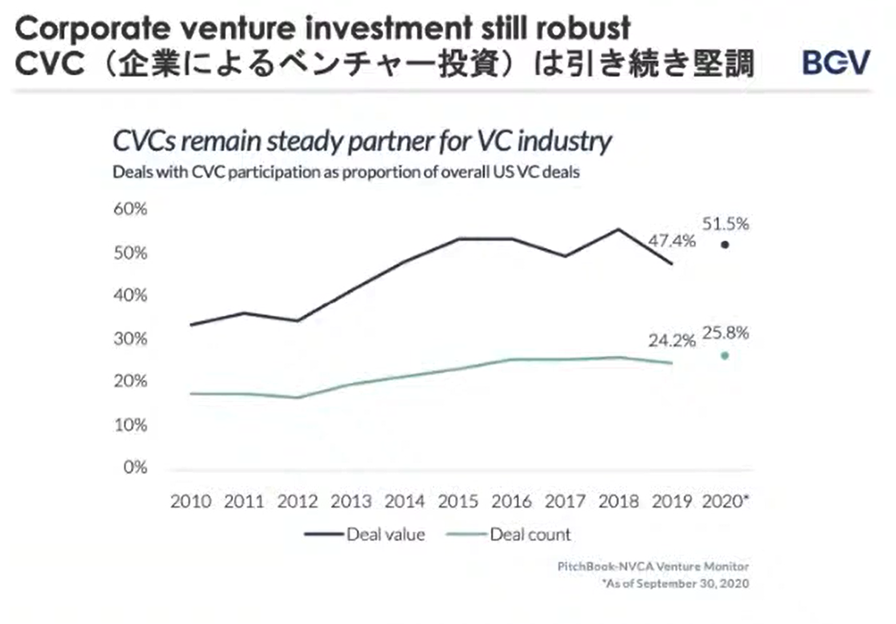

Corporate venture capital firms remain steady partners for VCs, and deals including CVCs are expected to rise from 47.4% to almost 52% of aggregate deals. The majority of this increased activity and attention is focused on capital investments into cloud technologies, and further, it is directed towards larger, later-stage companies, resulting in a surge of public stock offerings.

BGV portfolio company Grid Dynamics presents a case in point. The IT services provider, specializing in cloud solutions for retail, finance and technology sectors, IPO’d in March 2020 through an SPAC. Even amid a global crisis, Grid Dynamics managed to go public two years earlier than expected (had they taken the traditional route). This pays testament to BGV’s investment strategy, focused on clear value-add solutions in key growth sectors, as well as the partners’ ability to leverage downstream relationships, even while facing headwinds. Grid Dynamics represents just one of many BGV startups that have taken remarkable steps forward, and even thrived, against the backdrop of an uncertain and volatile terrain.

BGV’s unique investment approach employs a cross-border strategy that has, and will continue to, provide attractive returns. Leveraging the team’s broad global experience and intimate understanding of how to build competitive global companies, BGV takes a hands-on approach to cross-border teams, helping them establish a hub in Silicon Valley while leaving distributed operations back home. On the whole, cross-border companies enjoy a 2.1x a revenue growth premium, compared to market competitors. Further, cross-border M&A’s exit with an average valuation increase of approximately 5.6x, compared to 3.7x market average increase for locally-focused companies; and for those that make it to IPO, cross-border companies can expect a 6.4x increase, compared to the 5.5x market average.

To build and scale global cross-border companies, and drive results, BGV has crafted a high-level playbook for success. This includes everything from establishing company culture, to building a globally mindset, and focusing on clear areas of competitive advantage. The playbook will be discussed further in a later blog post.

The BGV Portfolio Speaks

The event concluded with presentations from Scalefast, Secret Double Octopus and Drishti.

- Coming off of a $22M Series B, Scalefast, a French-American cross-border company, simplifies eCommerce by bringing direct-to-consumer (DTC) solutions for companies looking to automate and streamline their business while scaling their brands globally. Scalefast CEO Nicolas Stehle provided company highlights.

- Secret Double Octopus, an Israel-US company, and a Forbes top “20 Best Cybersecurity Companies,” offers secure passwordless multi-factor authentication to major global brands such as United Technologies, 3M and FairPrice. SBO was listed for the third year in a row in the Gartner 2020 user authentication guide as a go-to solution.

- Drishti, named by NVIDIA as a “Top AI Company in North America,” also secured a Series B financing round over the summer, and presents, possibly, the purest example of an Enterprise 4.0 solution. By outfitting manufacturing plants with cameras, and recording the movements of workers on factory lines, Drishti can use metadata and AI to identify irregularities and help spot sources of product defects, inefficiencies or potential recalls. Click here to see a discussion on Deep Learning between Drishti CTO and Co-Founder Krishnendu Chaudhury and BGV GP Anik Bose.

A Q&A session followed the company presentations and Japanese audience members asked a wide array of questions. While Japan represents one of the world’s largest Enterprise 4.0 markets, it lags three to four years behind the US and Europe in adopting critical digital transformation solutions. Therefore, BGV partners believe it is essential to continue education and partnership development with Japanese hi tech community, as they serve as trusted gateways into this massive marketplace, and present tangible bridge points for BGV portfolio companies. Mas Sakamoto and Ikkei Matsuda provide boots on the ground to nurture these budding partnerships, and were instrumental in the execution of this event with KRP.

Additional information & Resources:

SARR JP: https://sarr-llc.com/topics-performancer/bgv-krp20201029/

SARR EN: https://sarr-llc.com/en/topics/bgv-krpseminar20201029/