On March 10th, we hosted a breakfast in Paris during Deep Tech Week, gathering investors, founders and corporates. This thematic breakfast was organized to discuss cross-border strategy with a focus on “How French startups can leverage Silicon Valley’s global launch pad”.

Why does it matter?

Cross-border tech companies are demonstrating impressive performance. In September 2019, Datadog successfully IPO’d at an impressive $8B valuation. The French entrepreneurs founded the company in the US while keeping the R&D in France. Grid Dynamics, one of our own cross-border portfolio companies, went public on the NASDAQ on Friday March 7th, valued at $660M.

At BGV, we believe that more and more successful companies will be conceived outside of the US but will need, at some point, to be connected to Silicon Valley for:

- Access to the US market;

- Establishing commercial and strategic relationships with the large tech companies (which are all concentrated there) and to be integrated into this ecosystem;

- Access to capital. In 2018, US VC funds have raised 4x more capital than European VC funds (Sources: Pitchbook/NVCA & 2019, State of European Tech by Atomico)

- Access to exit. Last year, one in four European M&A transactions was a US buyer. (Source: 2019, State of European Tech by Atomico)

Since our first fund in 2003, we’ve specialized in a cross-border investment model focused on three international innovation hubs: Israel, France and India. We are increasingly sourcing deal flow from French entrepreneurs and have helped companies like Platform.sh, Scalefast, and Madkudu make the leap to California.

Sam Levan, CEO of Madkudu, joined Eric Benhamou and Eric Buatois, both natives of France and Managing Partners at BGV, for a fireside chat to discuss the French Corridor to Silicon Valley and the emerging space of Enterprise 4.0.

“Revenue growth of cross border companies is 2.1x higher than that of locally focused companies”

Eric Buatois pointed out surprising (but true!) data points from a research study by Dr. Martin Haemmig, Professor at CETIM, with more than 17,000 companies. In addition to revenue growth acceleration, “the average M&A exit of cross border companies enjoys a 5.6x multiple, versus a 3.7x multiple for locally focused companies.” Cross border companies have also revealed higher IPO multiples with an average of 6.4x, versus 5.5x for localized companies.

Cross border exposure grants key advantages but it also comes with considerable challenges.

“Managing cross-border team requires organization, flexibility and clear processes”

According to Sam, who founded his startup in 2014 in Silicon Valley and opened an R&D office in Paris a few years ago, managing a cross-border team requires organization, flexibility and clear processes. He sharedhis secret sauce to create a dynamic work environment between teams who are located in different time zones. “Our favorite collaboration tools are Slack for written messages, MarcoPolo to communicate via videos and Notion to share company processes and organization.” Sam discussed other challenges he faces including the need to adapt his management style to each culture. “French employees need much more human interactions than Americans.” Then there are the differences between American and French Venture Capital funds.

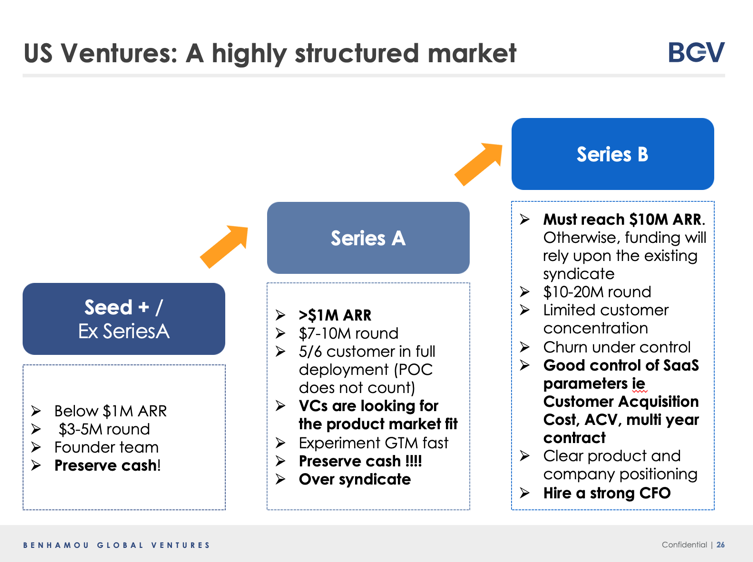

“Raising a Series B without reaching the $10M ARR threshold is very difficult, and almost impossible in the US”.

Eric Buatois encourages entrepreneurs to over syndicate the Series A round. The gate between Series A and Series B is tough as you must reach $10M ARR to attract investors for your B round. At the Series A stage, Eric emphasized a common mistake made by entrepreneurs: “POC does not count. You need to have 5/6 customers in full deployments to raise your Series A”.

How to build a successful global cross border company?

Eric gave some recommendations, including the following:

- Culture is key and it’s important to build a global mindset at the earliest stage of the company.

- Before considering the US expansion, entrepreneurs should perform a detailed assessment of the competitive landscape/funding environment and identify a clear potential to be the #1 or #2 in terms of market share. It’s crucial to have a well-defined source of competitive advantage.

- When expanding into the US, entrepreneurs would need to pay the market price for top talent. For example, a top VP of Marketing costs $250K/year.

- Operations management systems should be in place and validated before scaling.

Conclusion

The French corridor between Silicon Valley and France is robust and thriving. Our team enjoyed a lively and interactive discussion on various elements of the cross-border strategy FR/US including recruitment, go-to-market, fundraising, specificity and strengths of the French market. We welcome the opportunity to work with dynamic cross-border companies in this market, and are looking forward to more fruitful collaborations.