By BGV Summer Interns and MBA candidates at the Kellogg School of Management Jenieri Cyrus and Nick Giometti

More than six months into COVID-19, the nature of business networking and deal making has transformed drastically. Large in-person events had been a core embodiment of the tech ecosystem’s ethos. Events like CES, Dreamforce, and SXSW have long been places of pilgrimage for our industry, however, faced with a global pandemic, event organizers embraced an essential tenet of technology: adaptation.

The recent emergence of virtual events has forever shifted the dynamic of large-scale human interactions. To capture the feel and functionality of in-person events, both existing players and new entrants to the event organizing market have met the challenges of forced social isolation head-on and embraced their constraints as a constructive force for change. As a result, a flood of venture funding has rushed to virtual events companies in this nascent industry.

In this two-part series, we outline the magnitude of the pre-COVID events market, the catalytic changes the virus brought to the industry, and where we see opportunities to invest for its future.

State of the Events Market – Pre-COVID

To understand the market for Virtual Events in 2020, let us look into the events market pre-COVID disruption. The trade show and conference planning industry (not including sports, festivals or performing arts) represented a large and mature market of $16.6 billion in revenues in the US alone per IBISWorld. This industry is made up of conference organizers who plan, promote and manage events, such as trade shows, exhibitions, conventions, conferences and meetings, and provide staff to operate the facilities where these events take place.

Outside of the larger events, much smaller events range from small employee gatherings to company sponsored events to foster inclusivity and community building. In addition, in-person recruiting events bring organizations in direct contact with high quality job candidates. It is harder to ascertain the specific size of this last sub-segment, but it is not an insignificant slice of the market.

Events Revenue Generation

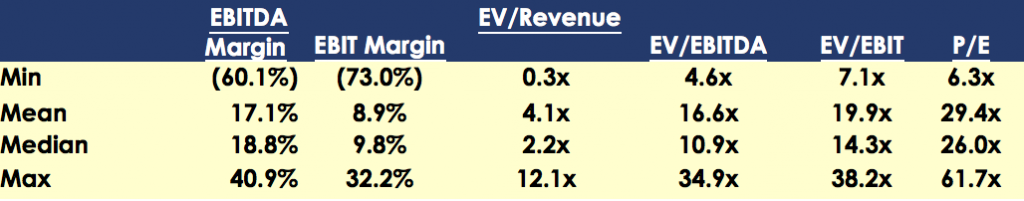

We looked at wide array of companies ranging from multi-billion dollar revenue companies, to mid sized public and private companies, such as DWTC, GL Events, Informa, Reed Exhibitions, Clarion, and Freeman, to some of the relatively smaller ones such as Clarion, MCH Group, Viad, DMG Events and Hyve group. The financials from 67 publicly listed event organizers show healthy financials, with significant EBIT margins (14.3x) and lower EV/Revenue multiples (2.2x).

The pre-COVID, event revenues were distributed amongst four major areas:

- Exhibit Sales and Design – An $8.18 billion market, the Trade Show and Conference Organizing industry includes the sale of “floor space” at trade shows, conferences, conventions and expos. Clients purchase space to model and market products or services they provide directly to consumers or to downstream businesses. Prime real estate offering the greatest exposure to event attendees generate a substantial share of revenue for this segment. Organizers and exhibitors have evolved multiple strategies to maximize revenues, such as additional services for design and installation, food, transportation, and the like. This segment has been hit hard due to COVID and the inability to host the live events that this entire segment depends on.

- Registration, analytics and show-related services – A $2.77 billion revenue segment, this includes sign-up, name badge printing, online registration and on-site registration services. The upstream registration process is particularly important to ensure that attendees receive the appropriate materials for the event, such as advance mailings and scheduling information. A smooth registration process reduces attendee wait times, and some operators offer online registration to expedite the process upon arrival. Some operators also provide session tracking (in house or via third-party) to determine which attendees participated in what events, statistical reports and other data management services. In live events, these statistical and analytical services were woefully manual and often provided by providing attendees with a scannable name badge tagged across the event. Innovation is well underway in this segment as evidenced by the incumbent upstream providers on the market today (Eventbrite, Ivolio, etc.). The downstream vendors who handle the real-time in-conference and post-conference data will become even more important as in-person events are ever to be replaced by hybrid events (more on this later).

- Sponsorships and advertising sales– A $3.65 billion revenue segment, this includes sponsorship and advertising sales, providing customers with additional exposure to attendees and potential customers. Clients can provide event memorabilia and purchase advertising space throughout the event. This segment will need to be reimagined in a world without in person events. Event organizers will need to find engaging digital replacements for the platform on which their clients could gain exposure.

- Shipping, logistics and other services– A $2 billion revenue segment, this would include organizing transportation and accommodation services for attendees that are traveling to attend an event, marketing services for the event, construction and dismantling of exhibits, on-site staffing and logistical support and general management of an event, such as providing a venue, catering and security. This segment has been hit hard due to COVID. This segment also requires a high amount of wages and human capital to generate revenue, so organizers may be happy to see revenue shift away from this segment. However, in a virtual world, many of these services will have a virtual counterpart that needs to be provided to attendees. Organizers will either need to build muscles around these online services or hire a third party to do so.

Each of these segments will be altered in different ways due to COVID’s impact on travel and in-person events. The development of virtual events redistributes the share of revenue each of these buckets represent, and marks a potential shift to hybrid event organizing in a post-COVID ‘new normal.’

While this very profitable industry undergoes massive disruption, we have to understand how budgets will be reallocated in the purchase decision for new technologies. Typical expenses have been spread across the following key areas: wages (25%), employee travel, security and insurances (32%), marketing (3%), and other costs such as bank fees, interest charges, telecommunications costs, legal fees, overhead charges etc (about 22%). Together, these costs are expected to account for 22.5% ($3.7 billion) of industry revenue in 2020. With a better understanding of the live event market, virtual event startups can supplement, replace and augment both revenues and costs for organizations that organize these events.

While there are communication platforms that can augment many of the use cases mentioned, virtual events, specifically, are meant to replace larger scale events such as trade shows and exhibits with a virtual representation. These platforms also enable organizations to host non-revenue generating events such as recruiting/HR events or internal community building events. The virtual event industry will likely be segmented along multiple dimensions – across type of events from large virtual events to hybrid events, types of purpose – from sales oriented to community style to intimate VIP experiences, to types of interactions – facilitating smaller 1: 1 conversation or few:few conversations to one: many broadcasts in a webinar or webcast style conversations. We will cover this in more detail in Part II of this series.

The major takeaway is that the COVID pandemic has forced a multi-billion dollar industry to completely turn on it’s heels to avoid complete and utter shutdown, in ways that few industries have had to contend with. Along with the challenges faced by in-person events, new opportunities have risen as well. The advent of new Virtual Event platforms are stimulating novel “top of the funnel” opportunities that will have strong residual effects for organizations. The opportunity to recruit talent, build teams, network, and engage with customers and other relevant stakeholders in asynchronous and distributed ways will unlock efficiencies and enormous savings in costs and resources in just about every industry imaginable.

New user experiences have been emerging at a rapid pace over the past few years and, from an investor’s perspective, this represents a trendline that cannot be ignored. Companies in the Virtual Event space have emerged to target a number of subcategories and use cases, and the most relevant and visionary are still very early in their lifecycle. With this industry being so nascent we expect to see a handful of winners emerge overtime. Part II of this blog will discuss our thoughts on where we think the industry is headed post-COVID, what needs to be solved for winners to emerge, who we think those winners may be and why. Stay tuned!