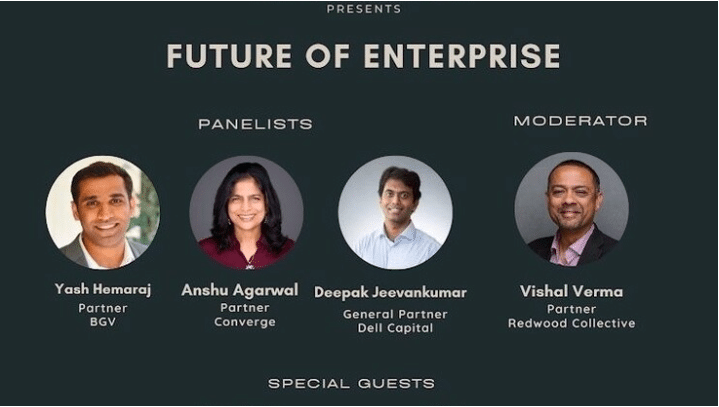

September 25, 2023 | By Yashwanth Hemaraj, General Partner at BGV and Founder of Arka Venture Labs

Sidebar Summit and BGV hosted a great gathering of entrepreneurs, investors and execs from multiple industries at our BGV offices in Menlo Park in August 2023. Thank you to all who participated in the lively discussion.

Among many other topics, we discussed what are VCs looking for when investing in enterprise technology today versus what they were looking for 2 years ago? I captured some of my thoughts from that part of the discussion:

In recent years, the yardsticks by which we measure startups in this domain have undergone a profound evolution. As investors, we constantly recalibrate our perspectives and strategies to align with the industry’s dynamic nature.

I shared some of the pivotal considerations at the forefront of our minds as we evaluate enterprise technology startups today, juxtaposed against the past two years.

1. Sustaining Differentiation in the Generative AI Era: Once upon a time, companies invested substantial time and effort in research and development to carve niches in areas like voice processing, transcription, translation, and video processing. However, the advent of generative AI has irreversibly shaken these domains. Companies who have raised hundreds of millions in venture financing in the voice and video analytics space are under threat of massive disruption and democratization from Generative AI. We now ask ourselves, “What sets this company apart in the Generative AI era?” and “What constitutes its long-term competitive edge?” Sustainable differentiation entails forecasting how startups will stand out and stay pertinent amidst rapid advancements. Their ability to harness generative AI and other technological leaps to continuously innovate and adapt has become paramount.

2. Mastery of Data for Disrupting Industries: In an environment characterized by macroeconomic shifts like supply chain transformations, climate change, geopolitical complexities, and inflation, the ability to skillfully utilize and harmonize diverse data sources stands as a potent distinguishing factor. Founders who adeptly blend their enterprise’s unique context with publicly accessible third-party data position themselves to disrupt legacy industries through holistic, integrated solutions.

3. Customer-Centricity and Genuine Pain Point Understanding: The days of superficial engagement and mere aspiration in the startup realm are behind us. Today, a company’s survival is intricately linked with its profound comprehension of customer pain points and its capacity to amplify human capabilities. Victorious startups boast founders with firsthand experience of these pain points and a sincere ability to empathize with their customers. While entrepreneurs have an array of AI technologies at their disposal, the true distinction arises from how adeptly they employ these tools to alleviate customer challenges. Genuine innovation emerges at the nexus of technology and an authentic grasp of customer needs. It’s crucial for startups to package these solutions into a comprehensive, vertical-stack approach, crucial for even the most entrenched industries to embrace transformative change. We stress that ethics, privacy, and security should be ingrained at the core of data strategies, not treated as an afterthought. Startups proficient in navigating these considerations capture our attention. We term such human-centric, AI-driven companies as part of the Enterprise 4.0 concept.

4. Efficiency of Capital and Resilience in Macroeconomics: The past decade characterized an era of unprecedented quantitative easing and almost negligible interest rates, fostering a climate conducive to risk-taking. However, the landscape is shifting; interest rates are ascending. As investors, we now seek startups that can thrive within the constraints of limited capital. Startups demonstrating capital efficiency and a lucid comprehension of their financial levers, coupled with the adaptability to weather challenging macroeconomic conditions, stand out. Moreover, founders who cultivate close, collaborative relationships with their investors and advisors are better equipped to navigate obstacles and seize opportunities.

In summation, the evaluation criteria for enterprise technology startups have witnessed substantial evolution over the past couple of years. Sustainable differentiation now hinges on the ability to navigate disruptions brought forth by generative AI, authentic understanding of customer tasks and customer pain points, mastery of data for industry transformation, and the establishment of capital-efficient ventures with macroeconomic resilience.

Our Enterprise 4.0 thesis and cross border strategy fits well within this new construct. As venture capital investors, we eagerly seek founders who embody these qualities, are willing to roll up their sleeves, and collaborate to construct the next generation of transformative enterprises.