Significant macro trends are reshaping the global energy landscape. Energy consumption continues to surge, driven by rapid digitalization, electrification of transport, and increased manufacturing output. Power-intensive sectors such as data centers, AI compute clusters, and electric vehicle charging networks now represent a growing share of total demand, contributing to rising energy prices and localized supply bottlenecks. This accelerating demand, combined with the variable and weather-dependent nature of renewable generation, is putting immense pressure on aging grid infrastructure—much of which was designed for a one-way flow of energy and is ill-equipped for today’s distributed, multi-source generation model.

As a result, energy management at the enterprise and industrial level has become increasingly complex. Companies now navigate a mix of traditional and renewable sources, volatile prices, and regulatory requirements that vary by market. Managing this diversity effectively requires advanced software tools for forecasting, optimization, and real-time decision-making—a trend that is fueling a wave of innovation in energy intelligence and grid orchestration technologies.

At the same time, the geopolitical and environmental imperatives for energy independence are reviving interest in nuclear power. After decades of underinvestment, nations such as Japan, France, and the United States are ramping up nuclear capacity, targeting a twofold increase by 2040 and a threefold increase by 2050. Coupled with progress in small modular reactors (SMRs) and fusion research, this shift marks a pivotal rebalancing of the global energy mix. For startups and investors, it opens new opportunities at the intersection of energy resilience, digital management, and decarbonization technologies.

Why Now: A Market at an Inflection Point

The market is at an inflection point due to the combined pressures of regulations, rising costs, and technological advancements.

- We are seeing a fundamental transition to a decentralized grid, moving away from traditional centralized structures.

- This transition is driven by the need to integrate unstable renewable energy sources and manage growing, complex demand. In 2024, renewables supplied just over 30% of global electricity, with wind and solar alone reaching around 15% of electricity generation, up from 4% in 2015 (source).

- The significant increase in energy demand from AI and data centers is putting a major strain on existing infrastructure, with data centers consuming roughly 415 TWh of electricity in 2024 (around 1.5% of global demand) and projected to more than double to about 945 TWh by 2030—equivalent to Japan’s total current electricity use – while up to 20% of planned data centers risk delays in grid connection (source).

- AI plays a critical role in enabling this transition and addressing market needs. AI can help optimize energy usage patterns, predict demand, manage resources, enhance data center management, plan new grids, improve efficiency of distributed resources, analyze geological data for mineral exploration, inspect infrastructure, and build knowledge systems in complex sectors like nuclear.

- The impending lack of critical minerals required for clean energy technologies is driving an accelerated need for research and discovery solutions now, as demand for key minerals such as lithium, nickel, cobalt, graphite, copper, and rare earth elements is expected to at least triple by 2040, with total critical mineral demand reaching around 35 million tons annually and related investment projected to grow from about 45 billion dollars in 2023 to roughly 800 billion dollars by 2040 (source).

Insights from the Field: Where Innovation Is Concentrated

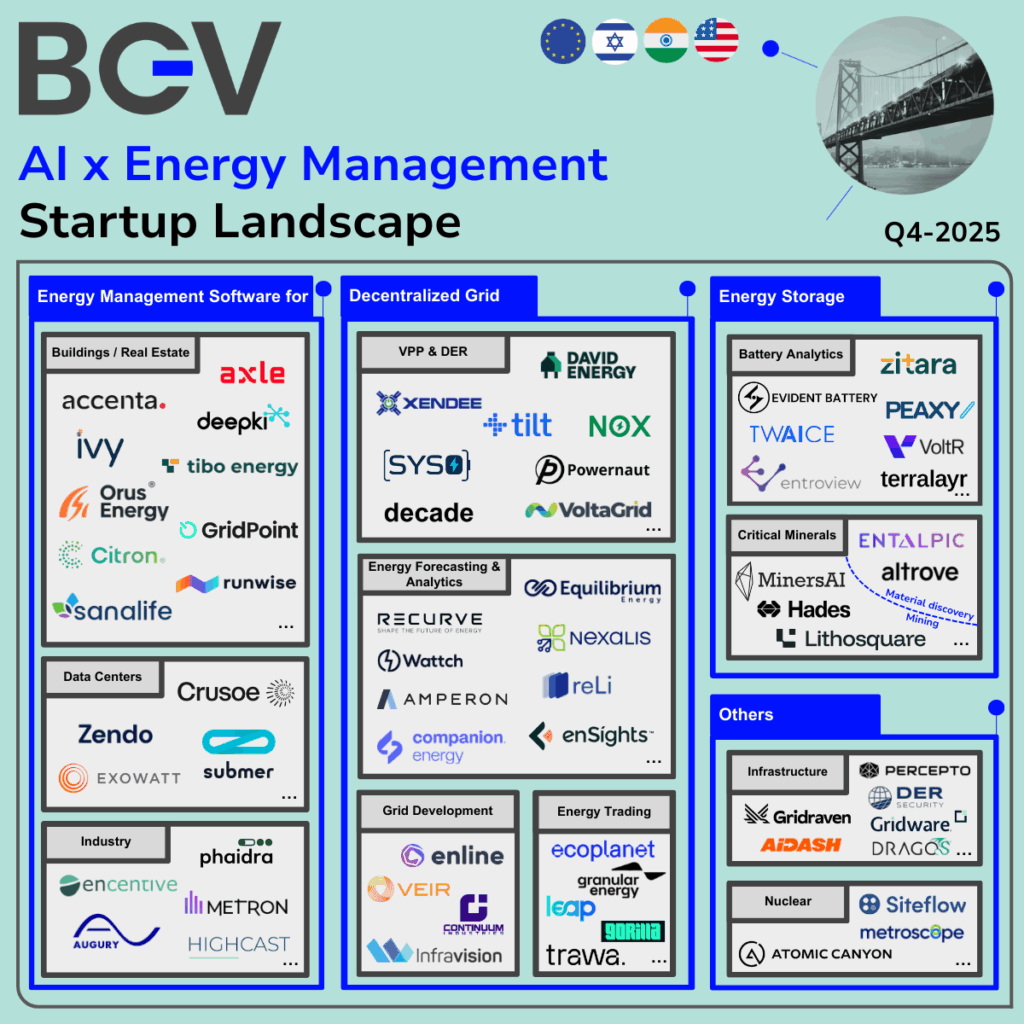

Energy management innovation is now permeating every layer of the market, from buildings to infrastructure, creating a multi-dimensional landscape:

- Energy Management Software (EMS): EMS platforms for buildings, industry, and data centers are now essential for optimizing energy usage and meeting regulatory requirements. Companies like Effy, GridPoint, Orus Energy (buildings) and Crusoe, Zendo, Submer (data centers) automate consumption, integrate real-time analytics, and help organizations attain sustainability certifications.

- Decentralized Grid Solutions: the rise of virtual power plants (VPPs) and distributed energy resources (DERs) reflect a fundamental shift in how grids balance unstable supply and complex demand from renewables. Startups such as Xendee, David Energy, and VoltaGrid aggregate and orchestrate distributed assets, driving flexibility and enabling dynamic energy trading.

- Energy Storage & Battery Analytics: while new battery hardware remains less software-driven, the need for battery analytics software is surging. Players like Entroview, TWAICE, and Peaxy use predictive diagnostics and optimization tools to extend battery lifespan and enhance performance, vital for both grid-scale and mobile storage.

- Critical Minerals Discovery & Management: innovation in critical minerals is advancing along two distinct tracks: on one side, startups like Altrove and Entalpic focus on developing new advanced materials, leveraging AI-driven modeling and computational chemistry to create compounds with enhanced energy and storage properties; on the other, companies such as MinersAI and Lithosquare accelerate the discovery and assessment of existing mineral deposits, applying machine learning and geospatial analytics to make exploration faster and more accurate.

- Grid Security & Infrastructure Protection: as grids decentralize and threats increase, cybersecurity and remote infrastructure monitoring have become must-haves. Startups such as DER Security, AIDash, and Percepto enable real-time detection of both cyber and physical risks, protecting aging and modern assets alike.

- Nuclear Energy Knowledge Management: with renewed interest in nuclear as a clean energy pillar, retaining institutional expertise is a growing challenge. Specialized software solutions from companies like Siteflow and Atomic Canyon help capture, structure, and transfer critical knowledge as the sector scales and veteran experts retire.

Areas We Double Down On

Based on our analysis, several sub-verticals align with our investment thesis and represent key areas of focus for BGV.

- Energy Management in Buildings & Real Estate: we see opportunity in software solutions that integrate with existing hardware and provide advanced analytics for optimisation, driven by regulations and the need for efficiency. This is why we recently invested in Sanalife, an AI platform that unifies energy intelligence, automation, and compliance to optimise building performance and reduce costs.

- Energy Management for Industry: factories are a high-potential and often underserved market needing solutions for optimising energy use with real-time monitoring, smart automation, and AI-driven software for process improvement and cost cutting. We previously invested in Ecoplant (acquired by Ingersoll Rand), and are still enthusiast new solutions can emerge.

- Energy Management for Data centers: the significant increase in consumption due to AI growth drives a need for more energy-efficient data centers and EM solutions, potentially leveraging AI for workload balancing and predictive maintenance.

- VPP & DER: the transition to a decentralized grid necessitates systems that aggregate and control distributed resources, leveraging software and AI to manage unstable supply and demand and provide grid flexibility.

- Critical Minerals: the impending shortage of essential minerals for clean energy requires accelerated discovery, with software solutions, including AI, enhancing exploration and data management.

- Cybersecurity of the grid: with decentralized grids multiplying potential attack points, there is an increased focus and critical need for specialised cybersecurity solutions to protect grid infrastructure.

- Infrastructure Security: addressing the vulnerabilities of the aging grid requires improved solutions, including software and monitoring technology to detect problems quickly and prepare the grid for future challenges. Technologies such as AI-powered inspection and failure prediction – championed by BGV portfolio companies like AIDash and Percepto—are setting new standards for grid resilience by enabling remote monitoring, predictive analytics, and rapid incident response across critical infrastructure.

Conclusion: Why BGV, Why Now

Energy management is quickly becoming the digital backbone of the decarbonized economy. With rising energy demand and grid complexity, the use of AI, analytics, and automation is now essential for building resilient and scalable solutions across buildings, industry, and distributed energy networks. At BGV, our sector expertise and global network allow us to support ambitious founders innovating at the intersection of software, infrastructure, and cross-border energy. As advanced storage, distributed intelligence, and operational transformation reshape the sector, we’re committed to partnering early with entrepreneurs building the next generation of adaptive, intelligent energy systems.