Covid 19 has taken a devastating toll on human lives and spread unprecedented fear worldwide. It has precipitated a market decline that is steeper than any before, reaching bear market territory in less than a month. Economists have slashed growth projections as businesses close and employees are laid off. Many governments have implemented significant fiscal stimulus and monetary policies to alleviate the financial crisis. It is understandable, in this context, why many investors are rushing for the exit door. However, sophisticated investors realize that high alpha returns are seldom achieved by following the herd. Anik Bose, General Partner at BGV shares his view around the future prospects for early stage technology VC.

Early Indicators

While our B2B portfolio companies are experiencing different degrees of adversity from macroeconomic headwinds, most have avoided the extreme shocks faced by B2C startups with direct exposure to the consumer economy. As for upside, our portfolio has generated several positive value creation events over the past 90 days including one IPO, four successful re-financings, one M&A scale up transaction and two new seed investments. As enterprises seek to do “more with less” in segments such as e-commerce, healthcare, logistics and on demand cloud infrastructure, some of our companies are even experiencing tailwinds, driven by this acceleration towards automation. We believe that early stage investors who bias their portfolio construction towards sectors that adopt secular trends will build a strong foundation for future value creation.As Wayne Gretzky’ famously suggested, “skate to where the puck is going, not where it has been.”

Technology Sector Resiliency

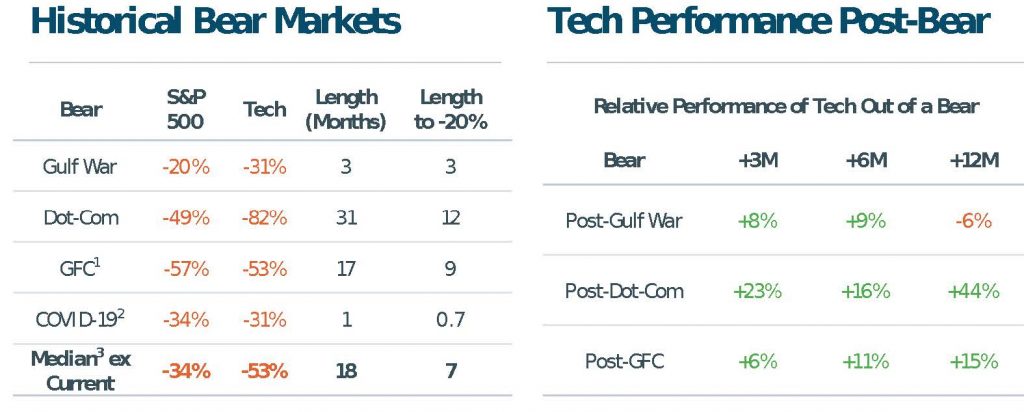

The VC ecosystem has weathered recessions before, and the technology sector tends to enjoy strong relative performance during economic recovery (See recent SVB analysis below highlighting the relative performance of Tech coming out of a bear cycle).

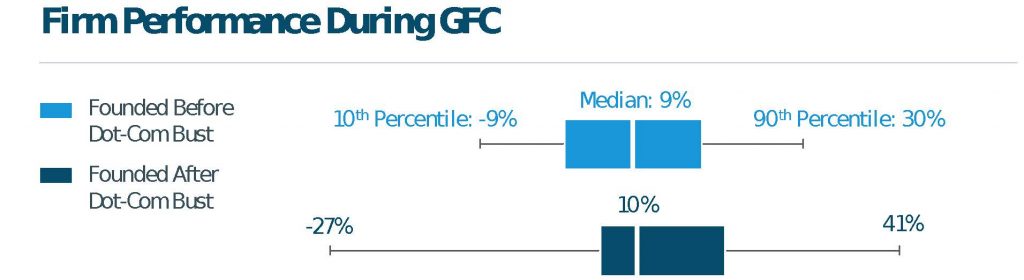

At BGV we believe that adversity drives technology innovation since it creates an abundant supply of talented workers, lower opportunity costs, and reasonable valuations, all while presenting a rare opportunity to ride the next wave of economic growth. Around 41% of today’s unicorns were founded during, or in the aftermath of, the 2008 great financial crisis, including Okta, Cloudera, Slack, Uber, Waymo, Square, Airbnb and DataDog. Similarly, amid the dot-com crash iconic companies that were founded include SFDC, Splunk, ServiceNow, DocuSign, Tesla, Facebook and SpaceX.

By investing in companies during the early stage, where our firm operates, not only are our investments more valuable (than later stages), but we can ride the value creation curve much longer, and capture the value generated all along that journey. Trough to peak, the investment potential for value capture has actually been expanded in the technology sector.

Experience Matters

We believe that experience matters in early stage VC. It requires a hands-on approach to company= building, and a rare skill set that our partners have cultivated over decades of experience. Unlike downstream funds, and other venture firms that specialize in later stage asset deployment, we work very intensely with our portfolio companies and forge deep partnerships with our founders.

Our “mantra” to portfolio CEOs and founders is that our job is to ensure that they avoid the mistakes we have made or have seen others make. This helps our portfolio companies to increase their number of at bats with capital efficiency and optimizes our fund’s loss ratio. Today, the majority of active VC firms have never seen a recession. SVB analysis below highlights that experienced VC managers deliver superior returns in challenging times like the Dot.com Bust and the Great Financial Crisis.

Conclusion

Despite headwinds posed by COVID-19, the shift from digitization to automation continues apace, and our investment thesis remains fully intact. In fact, the trends have accelerated. Early indicators, technology sector resilience and our own experience across economic cycles makes us bullish on the prospects for early stage B2B VC, even moreso when aided by an abundant supply of quality entrepreneurs and reasonable valuations. While the herd retreats, we look forward to the next growth cycle, and to shaping the arc of that growth with our partners.

Source for graphics: SVB State of Markets Q2 2020