By Emmanuel Benhamou and Smita Samanta

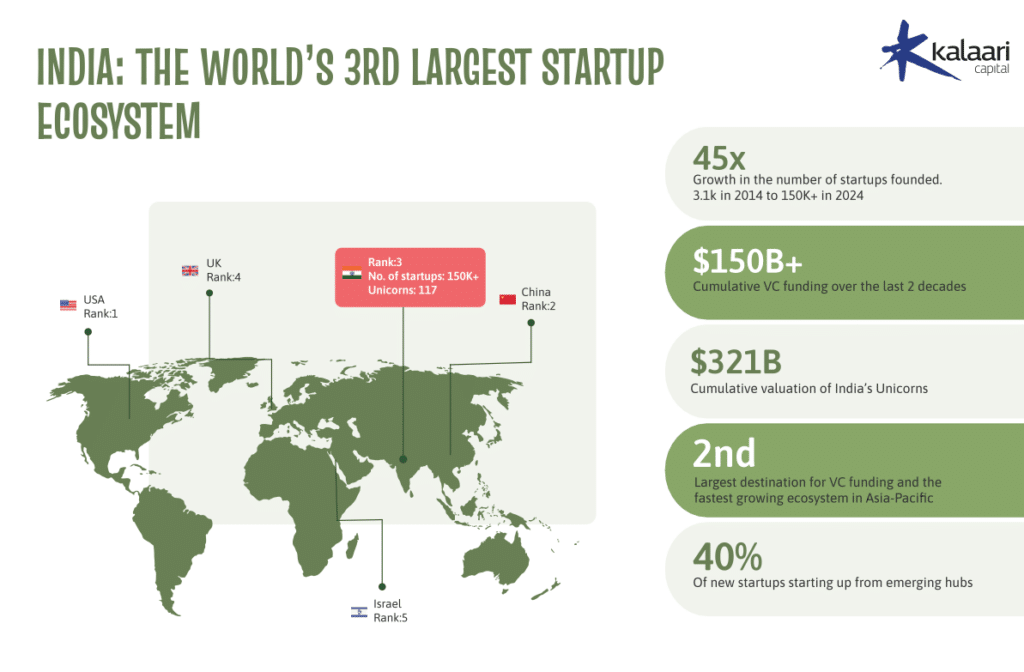

India’s venture capital landscape has entered a new era of maturity and innovation in 2025. As the world’s third-largest startup ecosystem, India has transcended its traditional role as a technology services hub to emerge as a powerhouse for enterprise innovation, particularly in AI and deep tech. The ecosystem’s transformation is evident in both quantity and quality: total VC funding reached $11.3 billion in 2024, marking a 43% increase from 2023. Yet the more telling shift lies in where this capital is flowing – investment patterns reveal a decisive move toward sustainable, technology-driven enterprises built for international scale.

This evolution comes at a pivotal moment in India’s economic trajectory. As the country positions itself to overtake Japan as the world’s fourth-largest economy, its venture ecosystem is being shaped by three interconnected forces: the rise of AI-driven innovation, the emergence of international business models, and a new generation of founders building market-defining companies from day one.

Key Market Trends

The maturation of India’s venture ecosystem is evident in three distinct shifts that have emerged over the past 18 months. First, AI-native solutions have moved from being a market segment to becoming the primary engine of innovation. Indian AI startups raised over $5 billion in 2023, with B2B applications leading this surge. This shift marks a broader transformation: India’s traditional strength in services is evolving into leadership in enterprise product innovation.

Second, international expansion has become the norm rather than the exception for high-growth startups. This isn’t merely about Indian companies selling overseas – it’s about the emergence of “hybrid” enterprises architected for international success from inception. These companies build their technology in India while maintaining significant commercial presence in mature markets, particularly the United States. This model has proven especially powerful in the SaaS sector, where India now hosts over 450 companies generating more than $1M in annual recurring revenue – a 65% increase from 2023.

Third, there’s been a fundamental shift in how growth is financed. The venture ecosystem has shown robust expansion, with investment volumes growing 43% year-over-year in 2024. More significantly, the nature of this capital has evolved. Investors are prioritizing unit economics and sustainable growth over pure scale, reflected in the enterprise sector’s average deal size increasing to $10 million from $7 million in 2023 – a sign of more mature businesses attracting investment.

Challenges & Opportunities

While this momentum is significant, India’s venture ecosystem faces several structural challenges as it enters its next phase. The most pressing is the exit environment: despite recent high-profile tech IPOs showing promise, the overall exit landscape remains less developed compared to mature markets. This particularly affects B2B technology companies, which typically require longer runways to achieve meaningful scale.

These challenges, however, are counterbalanced by India’s unique structural advantages. The country’s demographic dividend stands out: by 2030, India will supply one in four global workers and is projected to be the only major economy with a talent surplus. With 32% of global STEM graduates, India possesses a distinct edge in technical talent – a critical advantage as business technology increasingly centers on the intersection of AI and domain expertise.

The government’s evolving policy framework further strengthens this position. A $2.4B allocation for AI research and development, coupled with modernized regulations around data privacy and international data flows, has created a more predictable environment for technology companies building solutions for global markets.

BGV’s Role & Strategy

In this maturing ecosystem, venture firms play a crucial role in bridging remaining gaps between India’s potential and global opportunities. At the intersection of these trends sits BGV’s unique approach to technology investment in India, anchored by two key initiatives: its pioneering focus on Human-Centric Enterprise AI, and Arka Venture Labs, its strategic platform created in partnership with Blume Ventures to catalyze innovation across borders.

This positioning directly addresses key market challenges: while India has the talent and technical capabilities, startups often need specialized guidance to navigate international markets and achieve successful exits.

While firms like Sequoia, Accel, and Tiger Global have historically dominated India’s venture landscape, BGV’s specialized focus sets it apart in an increasingly competitive market. Through its cross border investment model, BGV has created a powerful launchpad for startups bridging the India-US corridor. This platform goes beyond traditional venture funding, providing entrepreneurs with the infrastructure and networks needed to build category-defining companies. This cross border VC platform, championed in Israel, and leveraged with other global innovation hubs, has proven particularly strategic, combining deep local expertise with international market insights.

BGV’s investment thesis centers on Enterprise 5.0, emphasizing Human-Centric Enterprise AI. This approach recognizes that the next wave of innovation will not be about AI replacing human workers, but rather creating sophisticated systems that augment and enhance human capabilities. This vision manifests in investments across sectors where human expertise and AI create powerful synergies, exemplified by portfolio companies like AiDash, which uses AI for satellite-powered infrastructure management, and Everest Labs, pioneering AI-driven robotics for automation.

Future Outlook

The next five years will likely see a fundamental shift in India’s venture ecosystem. Beyond the current wave of SaaS and deep tech innovation, we anticipate the emergence of category-defining companies that combine India’s technical depth with sophisticated understanding of global enterprise needs. These companies will not just participate in international markets – they will shape them.

By 2030, India is poised to become a primary source of enterprise AI innovation, particularly in sectors where human expertise and artificial intelligence intersect. The maturing exit environment, coupled with growing international investor confidence, suggests the emergence of multiple billion-dollar companies built on human-centric AI principles.

In this evolving landscape, BGV stands as a bridge between Silicon Valley’s enterprise expertise and India’s technological capabilities. By fostering deep connections between these ecosystems, BGV is helping create a new category of companies that are built in India but poised for global impact.

For BGV, this represents more than an investment opportunity – it’s a chance to architect a future where technology enhances human potential, revolutionizing how businesses operate worldwide.